Approx. 50 market participants came togehter to discuss amongst others the following issues:

- Latest activities of ESMA regarding the regulation of securitizations

- Where do we stand concerning the introduction of STS?

- Are there first lessons learnt and what could be their impact?

- What does it mean to involve a STS verification agent?

Representatives of EBA, ESMA as well as numerous originators, arrangers and investors reflected a broad spectrum of the market. Many issues that had been discussed a week earlier in the course of the TSI workshop were on the agenda again and basically confirmed.

Additionally, the following aspects appeared to be important:

- In coordination with ESMA and EIOPA, EBA is investigating whether the STS framework could be also applicable for synthetic securitizations.

- So far, originators habe been able to cope with the STS challenges and meet the respective requirements.

- It is expected, that willingness to undergoe the STS process will increase in 2020 as new LCR (Liquidity Coverage Ratio) guidelines will be in place with a beneficial treatment of the STS-label

- Accordingly a pricing differential between STS compliant deals and and STS deals, which currently hasn’t been observed, is widely expected.

- This should be further enforced by the expiry of the transitional capital adequacy rules.

- Due to the potentially significant punishments and penalties, originators should be sufficiently incentivised to meet the highest quality standards with regards tot he provided data.

- Accordingly, risk management has been a driver for external STS certification.

- Usually, once all relevant documents have been provided, the actual certification process takes 3-6 weeks according to STS Verification International GmbH.

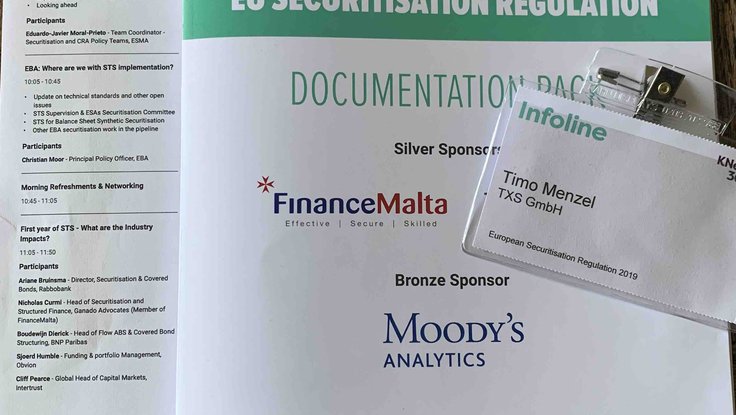

TXS GmbH is a TSI Partnerplus regularly getting involved by means of sponsoring conferences and other events for the benefit of the securitization market. In doing so, TXS seeks to contribute to the further promotion of the German and European asset based finance markets and is willing to pro-actively accompany its further development and enhancement.